how to lower property taxes in georgia

Georgia Sales Tax Rates. So for example a typical homeowner in Georgia will pay taxes on the value of his or her house the improvements and the lot.

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

Check Eligibility For Property Tax Exemption.

. Fulton County A county-wide sales tax rate of 3 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. One way to lower your property tax is to show that your home is worth less than its assessed value. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value.

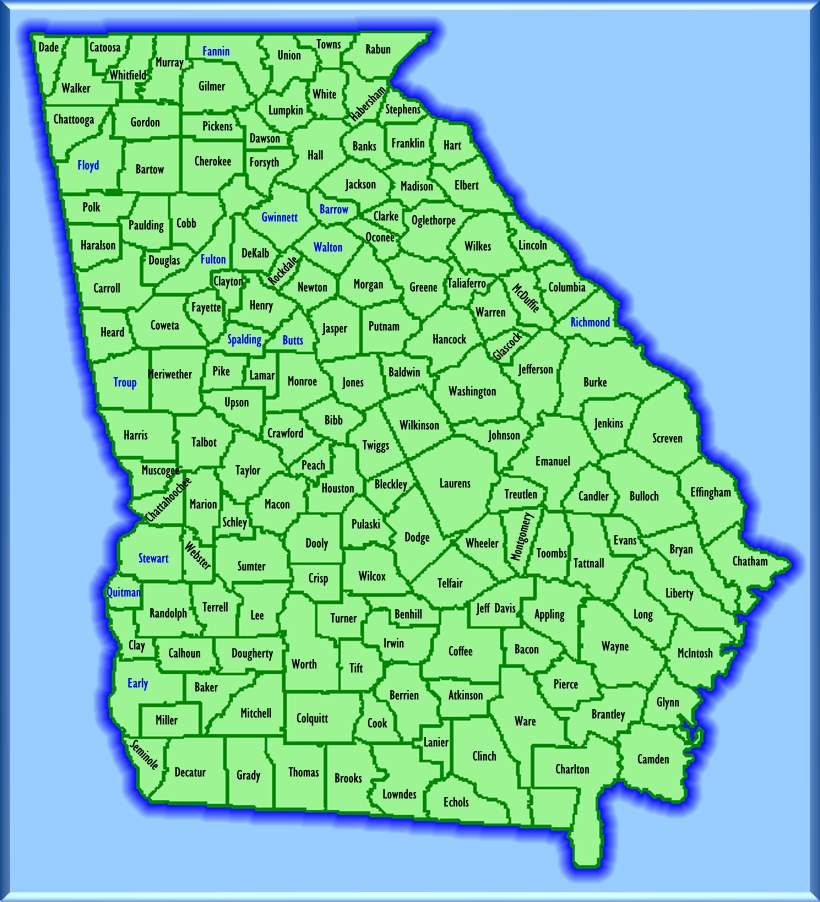

Know Your Municipalitys Appeal Requirements. First understand that all property in Georgia ie land improvements and personal property is subject to being taxed unless it qualifies for a specific exemption under state law. These vary by county.

Foreclose the lien in court called a judicial tax sale and then sell the home. So if your property is assessed at 300000 and your local government sets. When people get their annual notice of assessment in the mail thats when they typically get fired up about lowering their property taxes.

083 of home value. Ill be happy to help you find the answers to your questions. Also you might be offered.

The following options exist to help lower your property taxes. Up to 25 cash back hold a tax sale without going to court called a nonjudicial tax sale or. Other counties in Georgia have much lower rates meaning that the state as a whole is one of.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. Ad 2022 Latest Homeowners Relief Program. Mortgage Relief Program is Giving 3708 Back to Homeowners.

There are also a number of property tax exemptions in Georgia that can reduce your homes assessed value and therefore your taxes. Tax amount varies by county. Property Tax Returns and Payment.

Some cities and local. Fulton Countys tax rate lies at approximately 108 slightly above the national average of 107. We are a property tax consulting firm that works to lower the property tax assessment for your commercial or residential property.

Look at Your Annual Notice of Assessment. The statewide exemption is. My name is Im an attorney.

File For A Homestead Exemption. The property tax system. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

Up to 25 cash back Are You Getting All the Georgia Property Tax Breaks You Deserve. Check Your Eligibility Today. County Property Tax Facts.

Check If You Qualify For 3708 StimuIus Check. New Yorks senior exemption is also pretty generous. Raise Concerns With The Tax Assessor.

Bremen residents in the Carroll County portion of the city could see a large increase in their property taxes if the county goes through with a plan to lower the local option. Typically you will simply need to fill out a. Upon which it sits the land but the owners possessions the personal property.

Up to 25 cash back Hello and welcome to Just Answer. Property Taxes in Georgia. Consumer Ed says.

The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. Appeal the Taxable Value of Your Home. You might know that the Georgia tax.

This is the data that you will need to be appealed if you hope to lower your property taxes. Know the assessment value of your home and the deadlines in your jurisdiction. Property Tax Millage Rates.

Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and up to 10 acres of land surrounding. Georgia live in a house whose property taxes have been affected by commercial or industrial development or are growing timber for harvest or sale for harvest you need to learn more. Property Tax Homestead Exemptions.

We lower the property tax burden for parcels all across Georgia and the Atlanta area. Counties where we reduce property taxes include Gwinnett County Fulton DeKalb Forsyth Fayette Hall Barrow Walton and any other Georgia county. You can do the initial research online in just a few minutes or by making a quick call to.

23 Apr Tips for Lowering your Property Tax Bill in 2020. Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your.

5 Property Tax Deductions In Georgia You Should Know Excalibur

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Historical Georgia Tax Policy Information Ballotpedia

2021 Property Tax Bills Sent Out Cobb County Georgia

2021 Property Tax Bills Sent Out Cobb County Georgia

Tips For Lowering Your Property Tax Bill In 2020 Atlanta Tax

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

What Is A Homestead Exemption And How Does It Work Lendingtree

Equitax Georgia Property Tax Appeal Services Tax Liability Reduction

Tips For Lowering Your Property Tax Bill In 2020 Atlanta Tax

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Property Taxes Laurens County Ga

Georgia Property Tax Appeals Explained By A Professional

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group