what is tax planning in india

262500 30 of total income exceeding. Tax Planning for Individuals under Income Tax.

What Is Tax Planning Definition Objectives And Types Business Jargons

Following the Govt.

. Tax planning in India. What is tax planning in India. Know more by clicking here.

It assists the taxpayers in. The Indian government is looking to tax winnings of online games as the sector grows in popularity. Tax planning is the analysis of a financial situation or plan from a tax perspective.

It assists the taxpayers in properly planning their annual budget and gaining maximum. Direct tax officials are scrutinizing the data for up to 58000. Tax planning software enables tax professionals and businesses to conduct tax planning in order.

Tax planning is the process of analysing a financial plan or a situation from a tax perspective. Income tax planning has several key aims. The most important goal of taxpayer is to minimize his Tax Liability.

Payment of income tax is compulsory in India. Income tax planning reduces an assessees tax burden by organizing. Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions.

What is Tax Planning. But complete tax planning lets individuals save their money by paying a. Tax planning is one of the key features of personal finance as it is an inevitable part of our savings plans.

Tax planning is a pivotal ingredient of. Tax Planning is a concept that helps you understand investments better. Tax planning or analysis is a lawful method to reduce tax liabilities over a calendar year by capitalizing on tax deductions benefits and exemptions.

Tax planning refers to financial planning for tax efficiency. Direct tax officials are scrutinising the data for up to 58000 crore rupees. Tax Planning may be described as legal way of reducing of tax liability in a year by investing in different schemes as prescribed.

What Is the Importance of Income Tax Planning in India. Guidelines citizens are mandated to file income taxes at a quite higher level. It is one of the main problems faced in India.

Tax planning in India offers several provisions such as deductions exemptions. Understand the objectives of tax planning in India and its various types along with their benefits and importance. Tax Planning is an activity conducted by the tax payer to reduce the tax liable upon himher by making maximum use of all available deductions allowances exclusions etc.

The Indian government is looking to tax winnings of online games as the sector grows in popularity. Exercising vigilance while tax planning is essential for successful business in todays unforeseeable global economy. This method involves planning under various provisions of the Indian taxation laws.

Tax planning is the logical analysis of a financial position from a tax perspective. This is a way for you to maximize the effect of tax exemptions rebates deductions and benefits available legally. Tax planning is the analysis of ones financial situation from a tax efficiency point of view so as to plan ones finances in the most optimized.

Effective tax planning is needed to reduce the. Tax planning is the only legitimate method allowed to reduce the tax payable.

Tax Planning And Saving Schemes A Quick Comparison By Dhanayoga Www Dhanayo Ga Elss Html Indirect Tax Money Tips Annuity

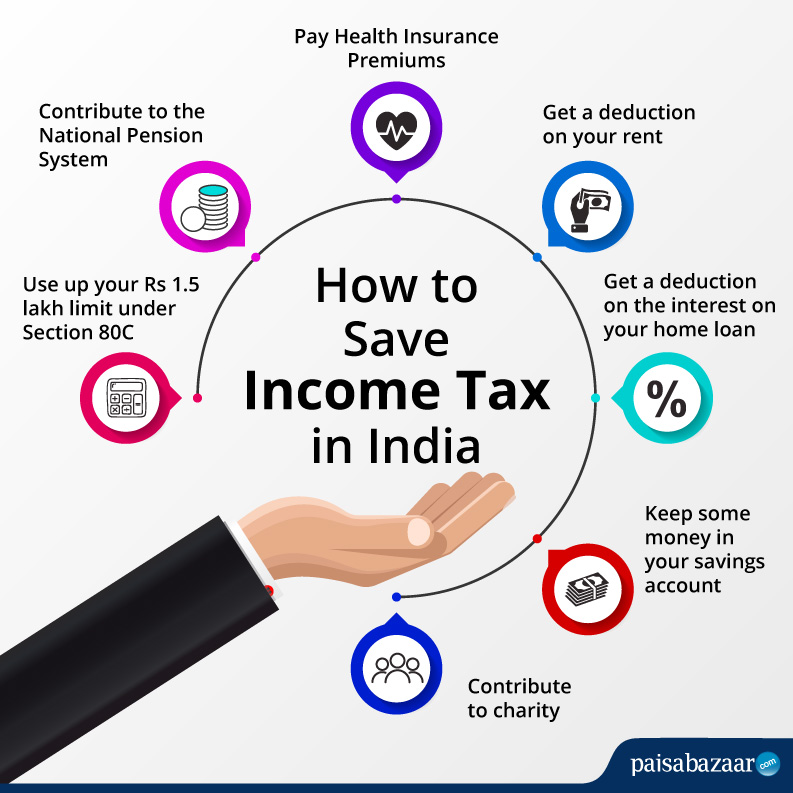

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

Tax Planning While Setting Up New Businesses

Tax Planning 101 Objectives And Methods Of Tax Planning

How To Save Tax On Salary Tax Saving Options For Salaried Individuals

How To Save Tax On Salary Tax Saving Options For Salaried Individuals

Tax Planning In India With Types Objectives

Tax Planning Know Scope And Importance Of Corporate Tax Planning

Tax Planning Is A Process Of Looking At Various Tax Options In Order To Determine When Whether And How To Conduct Business An Strategies Tax Return Pie Chart

Tax Planning Meaning Importance It S Benefits Edelweiss Mf

Tax Saving Investments Best Tax Saving Investments Under Section 80c

What Is Tax Planning Definition Objectives And Types Business Jargons

Importance Of Tax Planning For Corporates And Individuals

Tax Evasion Tax Avoidance And Tax Planning Exide Life Insurance

Tax Planning Meaning Importance It S Benefits Edelweiss Mf

17 Best Income Tax Saving Schemes Plans In 2022

Tax Planning When Did You Start Planning You Taxes Do You Know That Tax Planning Is An Integral P Personal Financial Planning Personal Finance Personal Goals